Total Amount Income Tax Collected From Family Offices by the Us Treasury

By Greg Leiserson, Senior Economist (CEA); and Danny Yagan, Main Economist (OMB)

Abstract: Nosotros estimate the boilerplate Federal individual income revenue enhancement rate paid by America's 400 wealthiest families, using a relatively comprehensive measure of their income that includes income from unsold stock. We practice so using publicly available statistics from the IRS Statistics of Income Division, the Survey of Consumer Finances, and Forbes mag. In our principal analysis, we estimate an boilerplate Federal individual income tax rate of eight.2 per centum for the period 2010-2018. We also present sensitivity analyses that yield estimates in the six-12 per centum range. The President's proposals mitigate ii primal contributors to the low estimated rate: preferential tax rates on capital gains and dividend income, and wealthy families' ability to avoid paying income tax on capital gains through a provision known equally stepped-upwardly footing.

When an American earns a dollar of wages, that dollar is taxed immediately at ordinary income tax rates.[1] But when they gain a dollar considering their stocks increase in value, that dollar is taxed at a low preferred rate, or never at all.[two] Investment gains are a principal source of income for the wealthy, making this preferential treatment of investment gains a valuable benefit for the wealthiest Americans. Yet the nigh common estimates of tax rates do not fully capture the value of this taxation do good because they apply an incomplete measure of income. This analysis asks: what was the average Federal individual income tax rate paid past the 400 wealthiest American families' in contempo years, determined using a more than comprehensive measure of income?

How the wealthy savour depression income tax: preferred rates on an incomplete measure of income

The wealthy pay low income taxation rates, year after year, for ii chief reasons. First, much of their income is taxed at preferred rates. In particular, income from dividends and from stock sales is taxed at a maximum of 20 pct (23.eight percentage including the net investment income taxation), which is much lower than the maximum 37 pct (twoscore.8 percent) ordinary rate that applies to other income.

2nd, the wealthy can cull when their capital gains income appears on their income tax returns and even prevent information technology from ever actualization. If a wealthy investor never sells stock that has increased in value, those investment gains are wiped out for income tax purposes when those assets are passed on to their heirs under a provision known as stepped-upwardly basis.

Analyzing a more than comprehensive measure out of income

Preferred tax rates on income from stock sales ("realized capital gains income") and from dividends feature prominently in commonly cited tax rates as well as in our assay.

An important feature of our analysis that is less common in existing estimates of revenue enhancement rates is that we include untaxed ("unrealized") upper-case letter gains income in our more comprehensive income measure as they accrue.[3]

Measuring income in this more comprehensive mode matters relatively fiddling for estimating most families' tax rates, as almost families have few investment assets.[4] Nonetheless, it matters greatly for the wealthiest families for whom such unrealized and thus untaxed gains are a big share of their income. Similar all other forms of income, unrealized majuscule gains income can be tapped to finance consumption and can ameliorate financial wellbeing.

A common reference betoken for defining income in economic science is known as Haig-Simons income.[5] Pre-tax Haig-Simons income equals families' alter in wealth, plus taxes and consumption. We define our income measure every bit families' change in wealth plus easily estimable taxes. Our definition of income is more limited than the Haig-Simons definition because it excludes consumption and other taxes, only it is a simpler way to include a substantial share of uppercase gains in income and can be implemented with publicly available data.[half-dozen]

Chief estimate and sensitivity

In our main analysis, we approximate that the 400 wealthiest families paid an average Federal individual income tax rate of 8.2 percent on $1.8 trillion of income over the period 2010–2018, the years from the terminal decade for which the necessary data are bachelor. Ii factors that contribute to this depression estimated tax charge per unit include low tax rates on the capital letter gains and dividends that are taxed, and wealthy families' ability to permanently avoid paying tax on investment gains that are excluded from taxable income. The 2022 President's Budget proposes to raise the capital gains and dividend tax rate and to virtually end stepped-upwards footing for the highest-income Americans, thereby ensuring these investment gains are subject to income tax.

The true revenue enhancement rate of interest may differ from our primary approximate. Beginning, excluding consumption and some taxes from our measure of income suggests that the viii.ii percent estimate is really college than the tax charge per unit measured relative to a truly comprehensive measure of income. 2d, the data and methods on which nosotros rely are imperfect. Dissimilar estimation choices illustrate the guess's sensitivity. For case, varying the analytic assumptions underlying one of our key methodological choices (discussed in greater detail in the technical appendix below) causes the approximate to vary from vi to 12 percent.

The tax charge per unit nosotros gauge is, of course, sensitive to changes in policy. The top majuscule gains taxation rate was fifteen percentage betwixt May 2003 and 2012 and has been xx pct (23.8 percent including the cyberspace investment income tax) since 2013. In addition, the Federal private income tax is only one revenue enhancement. Focusing on the individual income tax sheds light on the structural limitations of that tax and the telescopic for reforms, such as curtailing the power of the wealthy to avert paying taxation on their investment gains through stepped-up footing. However, culling revenue enhancement rates could also exist estimated that business relationship for other taxes, such equally the payroll tax, estate and gift tax, corporate income tax, and taxes paid to foreign governments. Moreover, ane could employ culling definitions of income or adopt various approaches to the treatment of certain subsidized activities such as charitable giving. Finally, we focus on an extended fourth dimension period (2010–2018), which helps to ensure that our analysis reflects the long-run reality of positive asset incomes despite short-run fluctuations. Withal, we also present culling estimates using unlike commencement and end years, every bit well as an guess that replaces the Forbes 400 wealth in 2009 with the boilerplate for the period 2008–2010.

Our primary approximate of eight.2 percent is much lower than ordinarily cited estimates of tiptop Federal individual income revenue enhancement rates. For example, the Joint Committee on Tax (2021) estimates that the 2021 Federal individual income revenue enhancement charge per unit on the pinnacle 0.4 pct of families ranked past income (i.due east., the 715,000 families with income over $1 million) volition exist 26 per centum. Our analysis differs by (a) analyzing a smaller group of families (the peak 0.0002 per centum) ranked by wealth, and (b) including unrealized majuscule gains income in the income measure. See the end of the technical appendix for boosted discussion of how our analysis compares to usually cited estimates.

Method

We emphasize that whatsoever estimate of tax rates on the wealthiest is uncertain and open to refinement, due to current data limitations.

We detail our method in the technical appendix below. In a nutshell, our method is every bit follows: nosotros accept the IRS Statistics of Income (SOI) Division'southward Federal individual income taxes paid past the top-400-past-income families and multiply it by an adjustment cistron constructed using the Survey of Consumer Finances (0.63) to convert it to an approximate of taxes paid by the top-400-past-wealth. We then estimate a more than comprehensive measure out of income equally the change in Forbes 400 wealth, plus our estimates of the top-400-by-wealth'due south Federal individual income taxes paid and State-and-local taxation deductions (estimated similarly based on Statistics of Income information). The ratio of the two yields our estimated tax charge per unit.

Conclusion

In this analysis, we used publicly available data to gauge the average Federal individual income revenue enhancement rate paid by America'south wealthiest 400 families, using a relatively comprehensive measure out of their income that includes income from unsold stock. In our primary analysis, we estimated an average tax charge per unit of 8.2 per centum for the period 2010–2018. We also nowadays sensitivity analyses that yield estimates in the half-dozen–12 percent range.

Preferential capital gains rates and stepped-up basis—a provision of tax constabulary that allows wealthy taxpayers to wipe out unrealized capital gains for income tax purposes when they laissez passer assets to their heirs—contribute to this low tax rate. The 2022 President'south Budget would increment majuscule gains rates and virtually end stepped-up ground for the highest-income Americans, thereby ensuring their investment gains are subject to income tax.

Technical Appendix

This technical appendix documents how we combine publicly available data from the IRS Statistics of Income (SOI) Division, the Federal Reserve Lath'southward Survey of Consumer Finances (SCF), and Forbes magazine'south estimates of the wealthiest 400 Americans to estimate the Federal individual income tax rate paid by the wealthiest 400 families. For reference, Forbes estimates that the 400 wealthiest Americans in 2018 had wealth ranging from $2.one billion to $160 billion. Our tax charge per unit guess is dollar-weighted: it is an estimate of total Federal individual income taxes paid past the wealthiest families, divided by an gauge of those families' income. We focus on the period 2010–2018 and study estimates for alternative periods as well.

We start draw the bones idea of the interpretation process so go through the details. We separate an estimate of the Federal individual income taxes paid past the 400 wealthiest families by a relatively comprehensive judge of their income. For the numerator, nosotros start past estimating the taxes paid by the families with the highest reported income on tax returns. And so we estimate how the income of the highest-wealth families compares to the income of the highest-reported-income families and utilize that every bit an aligning gene to gauge the taxes paid by the highest-wealth families. For the denominator, we utilise changes in the reported wealth of the Forbes 400 to estimate the income of the 400 wealthiest families.

Numerator: estimated Federal individual income taxes paid past the wealthiest 400 families

The numerator of our revenue enhancement charge per unit judge equals estimated 2010–2018 taxes paid by the wealthiest 400 families. We construct the numerator by estimating the 2010–2018 taxes paid by the highest-reported-income families, so multiply by an adjustment factor based on the Survey of Consumer Finances (SCF) to account for the fact that highest-reported-income families are not the same as the highest-wealth families.

SOI published estimates of the taxes paid by the 400 highest-reported-income families annually from 1992 through 2014. In a starting time and straightforward step, we extend this series through 2018. To exercise this, we rely on estimates of the total Federal individual income tax paid by the top 0.001 percent, available from SOI annually from 2001 through 2018. For the years 2001 through 2014, when both estimates are available, the ratio of taxes paid by the top 400 to taxes paid by the elevation 0.001 percent varies in simply a small window around 0.59. We therefore gauge the taxes paid past the 400 highest-income families for the menstruation 2015 through 2018 by assuming that it is 0.59 times the taxes paid past the summit 0.001 percent for this period. Our SOI-based judge of 2010–2018 taxes paid past the 400 highest-reported-income families equals actual SOI height-400 taxes for years 2010-2014, plus our estimates for years 2015–2018.

Our SOI-based estimate of 2010–2018 taxes paid by the 400 highest-reported-income families surely exceeds the 2010–2018 taxes paid by the 400 highest-wealth families: some of the wealthiest families have lower reported income and pay less revenue enhancement. For example, Warren Buffett was a member of the 2015 Forbes 400, but his voluntarily-released 2015 tax return information indicates 2015 adapted gross income of $xi.6 million (Cohen 2016). The thresholds for meridian percentile groups in 2015 in the SOI estimates show that $eleven.9 1000000 was required to exist in the meridian 0.01 percent (about fourteen,000 families). Thus, Buffett was non even in the elevation fourteen,000 tax units ranked by reported income, permit lone the acme 400 ranked by reported income. Moreover, he paid $ane.8 million in Federal private income tax in 2015, far less than the $36 million average for the top 0.001 per centum or the $9 million average for the top 0.01 pct. Equally a result, the 2015 taxes paid by the top 400 families ranked past reported income would overstate the 2015 taxes paid by the top 400 families ranked by wealth.

Hence, nosotros must convert our SOI-based estimate of taxes paid by the highest-reported-income families into an gauge of taxes paid by the highest-wealth families. We practise and so by multiplying the SOI-based guess by an adjustment factor of 0.63, constructed as follows from the Survey of Consumer Finances which contains information both on approximate reported income and on wealth.

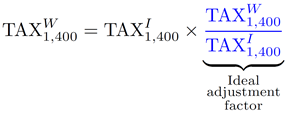

A formula helps to analyze the method. Our goal for the numerator of the tax rate is to estimate taxes paid by the families with wealth rank 1 through 400, which nosotros write as: Taxation Due west 1,400. The SOI data requite us an approximate of the taxes paid by the families with reported-income rank i through 400: Tax I 1,400. Ideally, we would multiply Revenue enhancement I i,400 by an aligning gene (in blueish) equal to the ratio of the taxation paid by the 400 highest-wealth families to the tax paid by the 400 highest-reported-income families:

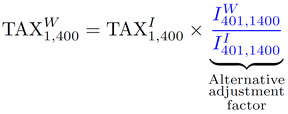

Nonetheless, the ideal adjustment cistron cannot be directly measured in publicly available data. The best available information source—the SCF—lacks information on taxes paid and excludes the Forbes 400 wealthiest from the survey sample past construction. We make two assumptions that allow one to estimate the platonic aligning gene using reported incomes among families ranked 401 through 1400 (i.e., the "next-one,000" groups ranked either by reported income or by wealth), which is approximately the rest of the top 0.001 percent. First, we assume that the highest-reported-income and highest-wealth groups pay the aforementioned average revenue enhancement rate.[7] Second, nosotros presume that the ratio of the reported incomes for the next-1,000 groups is the same every bit the ratio of reported incomes for the top-400 groups. Under those assumptions, i can replace the ideal adjustment gene with the post-obit alternative adjustment cistron that uses only next-grand information:

Estimating the reported income of the next one,000 past wealth IWestward 401,1400 is relatively straightforward: the SCF excludes the top 400 by wealth, and then we merely use the reported income of the wealthiest families in the SCF.[8]

Estimating the income of the adjacent 1000 by income II 401,1400 is more than challenging, as it depends on how much overlap at that place is between the Forbes 400 and the superlative 400 by reported income. If at that place is full overlap, then none of the top 400 by reported income should be in the SCF. We could then estimate II 401,1400 using the SCF observations with the highest reported incomes; doing and so would yield an adjustment factor of 0.44, similar to Saez and Zucman (2019).[9] At the other extreme, if none of the Forbes 400 is in the top 1400 by income, then the advisable SCF observations to use would be those with reported income ranks 401 through 1400. Doing and so would exclude many high-reported-income families from the adding and thereby yield a college adjustment factor of 0.66.[10] A higher adjustment factor leads to a higher resulting tax rate estimate.

We lean toward the conservative side of the spectrum: we presume an overlap of 100 and estimate II 401,1400 using the reported income of the SCF observations that represent families ranked 301 through 1300. Doing so, nosotros obtain an aligning factor of 0.63. Thus, our estimate of taxes paid by the wealthiest 400 families equals the SOI-based taxes paid past the 400 highest-reported-income families multiplied by our 0.63 aligning cistron.

Denominator: estimated income

We divide our estimate of taxes paid by the wealthiest 400 by our more than comprehensive judge of the wealthiest 400's income: their estimated alter in wealth, plus easily estimable taxes. This income measure excludes consumption and other taxes, which would cause united states to understate Haig-Simons income and therefore overstate the Federal private income revenue enhancement rate on Haig-Simons income.

To estimate comprehensive income for the 2010–2018 period, we begin past subtracting the total wealth (internet worth) of the Forbes 400 in 2009 from the total wealth of the Forbes 400 in 2018.[11] We then add ii boosted components of Haig-Simons income that are available in tax information: Federal private income taxes paid (estimated above) and State and local individual tax deductions (estimated from the aforementioned SOI data using the same 0.63 adjustment factor).[12]

Judge and sensitivity

Using our estimated numerator and denominator, our primary estimate for the 2010–2018 Federal individual income tax rate for the wealthiest 400 is viii.two percent. For the numerator, we estimate that the wealthiest 400 families paid $149 billion in Federal individual income taxes, equal to the $237 billion paid past the highest-income families in the SOI data multiplied by 0.63. For the denominator, Forbes estimates suggest that the wealthiest 400 experienced a change in wealth for the period 2010–2018 of $1.62 trillion. Calculation the $149 billion of estimated Federal individual income taxes and an analogously estimated $46 billion in State and local taxes, we estimate the wealthiest 400's income for the period 2010–2018 to be $ane.82 trillion. Dividing $149 billion past $1.82 trillion, we obtain 8.2 percent.

Appendix Table 1 presents a sensitivity analysis for dissimilar periods. Column 1 repeats our chief analysis for fourth dimension periods that begin in years other than 2010 (all ending in 2018). Our analysis for 2018 solitary yields 8.5 per centum, for the about recent five years yields 9.8 pct, and for the most contempo 20 years yields 10.2 percent. Cavalcade 2 repeats the exercise for fourth dimension periods that terminate in 2014, which is the last yr that does not rely on extrapolated tiptop-400 Federal individual income tax data (though it also includes fewer years with the higher mail service-2012 capital gains revenue enhancement rates). Our analysis for years 2010–2014 yields 6.ii percent and for 2014 alone yields 6.3 pct. In addition, replacing 2009 Forbes 400 wealth with its 2008–2010 average yields an estimate of 8.half dozen per centum.

Our 0.63 adjustment factor is estimated with fault. I of the most substantial risks to the accuracy of the estimate is if the income of the top 400 by wealth relative to the tiptop 400 past income differs consistently from the respective ratio for the next k. Other uncertainties include sampling or non-sampling error in the SCF data on which we rely. Under the extreme assumption that the highest income families are the highest wealth families, the aligning factor would equal ane, and the average tax charge per unit for 2010-2018 would be 12.3 percent. If, on the other manus, the highest wealth families take only 43 per centum of the income of the highest-income families post-obit Saez and Zucman'south (2019) assay, the average tax charge per unit would be v.8 per centum. If the highest wealth families systematically differ from the next k for whom information is available in the SCF, the ratio could, in principle, be even lower.

Nosotros ascertain our more comprehensive measure of income such that information technology is systematically lower than (pre-tax) Haig-Simons income, which includes all taxes and consumption. The SOI data contain data on ane boosted category of expenditure that could be included: deductible contributions to nonprofit organizations. When including these deductible contributions (estimated in the aforementioned way as nosotros guess Land and local taxes) in comprehensive income, we obtain an estimate of 7.9 pct.

Forbes 400 wealth is surely measured with error. An active literature studies and assesses wealth measurement at the very top of the wealth distribution (due east.k., Kennickell 2009; Johnson, Raub, and Newcomb 2013; Piketty 2014; Kopczuk 2015). Saez and Zucman (2016) use capitalized income taxation returns to, over some periods, judge faster growth in top wealth than does the SCF while mostly taking Forbes as given. In ongoing work, Smith, Zidar, and Zwick (2020) practice not publish peak 400 estimates, merely generally guess slower growth in acme wealth, which could be consistent with Forbes being misled, unable to value nontraded avails, or unable to observe gifts or debt. College growth in top wealth would pb to lower tax rates while lower growth in top wealth would lead to higher revenue enhancement rates. For example, if the Forbes 400 overstates top wealth growth by one-tertiary, our judge would be xi.7 percent.

Combining data across three cross-exclusive data sources yields some inconsistency in time periods studied. Our target population is the wealthiest in each year of the flow examined based on stop-of-year wealth. The Forbes 400 data are released each fall. The 0.63 adjustment cistron is based on families ranked by income in year t, compared to families ranked by wealth when surveyed at some point in twelvemonth t+i (though the reported wealth may or may not be current as of the time they were surveyed). Since the wealthiest families change over time, subtracting Forbes 400 totals across years understates the income of the wealthiest at the end of each year, which leads to overestimated tax rates.[xiii]

Our tax rate estimates are essentially lower than commonly cited top Federal individual income tax rates produced by the Congressional Budget Office, Joint Committee on Taxation, the Department of the Treasury, and the Tax Policy Centre.[14] These estimates differ from ours in three fundamental respects. Showtime, and most fundamentally, the Congressional Budget Office, Joint Commission on Taxation, the Treasury, and the Tax Policy Eye approximate tax rates relative to income measures that largely exclude unrealized capital gains. The analyses thus find substantially higher tax rates than we exercise because they, to varying degrees, exclude the untaxed income that motivates this analysis in favor of more than accurately estimated cash income flows. 2nd, tax-preferred realized capital gains are a larger share of income for the elevation 400 than they are for the larger tiptop groups for which these other estimates are produced. Third, we examine income tax rates by wealth rather than past income, and unrealized uppercase gains may exist even more than full-bodied among high-wealth families than high-income families.

We conclude this technical appendix by emphasizing the fundamental dubiousness in our estimates. We promise that our analysis stimulates further interpretation and direct measurement of income tax rates inclusive of unrealized capital gains income and by wealth group.

References

Bricker, J., P. Hansen, and A.H. Volz. 2019. "Wealth concentration in the U.S. later on augmenting the upper tail of the survey of consumer finances." Economics Letters 184. (Link)

Cohen, Patricia. 2016. "Buffett Calls Trump's Barefaced and Releases His Taxation Information." New York Times, October x. (Link)

Congressional Budget Office. 2021. "The Distribution of Household Income, 2018." (Link)

Johnson, B., B. Raub, and J. Newcomb. "A New Look at the Income-Wealth Connection for America'south Wealthiest Decedents." SOI Working Paper. Washington: Internal Acquirement Service Statistics of Income. (Link)

Articulation Commission on Tax. 2012. "Overview Of The Definition Of Income Used Past The Staff Of The Joint Committee on Tax In Distribution Analyses." JCX-xv-12. (Link)

Articulation Commission on Revenue enhancement. 2021. "Overview Of The Federal Taxation System As In Effect For 2021." JCX-18-21. (Link)

Kennickell, A.B. 2009. "Ponds and Streams: Wealth and Income in the U.S., 1989 to 2007." Finance and Economics Discussion Series 2009-thirteen. Washington: Board of Governors of the Federal Reserve System. (Link)

Kopczuk, Due west. 2015. "What Practice We Know about the Evolution of Elevation Wealth Shares in the U.s.a.?" Periodical of Economical Perspectives 29, no. 1: 47-66. (Link)

Piketty, T. 2014. Upper-case letter in the Twenty-First Century. Cambridge: Harvard University Printing.

Saez. E. and G. Zucman. 2016. "Wealth Inequality in the Us since 1913: Evidence from Capitalized Income Revenue enhancement Data." The Quarterly Journal of Economics 131, no. ii: 519-578. (Link)

Saez, East. and G. Zucman. 2019. "Progressive Wealth Taxation." Brookings Papers on Economic Activity Conference Typhoon. (Link)

Smith, One thousand., O. Zidar, and E. Zwick. 2020. "Peak Wealth in America: New Estimates and Implications for Taxing the Rich." Working paper, Princeton Economic science. (Link)

Tax Policy Center. 2021. "T21-0134 – Average Effective Federal Tax Rates – All Revenue enhancement Unites, Past Expanded Cash Income Income Percentile, 2021." (Link)

U.S. Department of the Treasury Function of Tax Analysis. 2020. "Distribution Table: 2021 001; Distribution of Families, Cash Income, and Federal Taxes under 2021 Electric current Police." (Link)

[one] A wage earner may defer taxation—subject to statutory limits—by contributing to a retirement savings account. Other mostly applicable taxation benefits may also reduce a worker's tax charge per unit.

[2] The minority of capital gains, realized inside one year of acquiring the underlying asset, is taxed at ordinary rates.

[three] Unrealized capital letter gains are the increase in the value of assets even before the assets are sold. A wealthy individual who purchases corporate stock worth $100 million that subsequently increases in value to $200 million over the next ten years has accrued $100 one thousand thousand of unrealized capital letter gains income over that period. These unrealized capital letter gains are a major source of income for the wealthiest Americans.

[4] For case, the Federal Reserve'south Distributional Fiscal Accounts approximate that, as of the first quarter of 2021, the top 1 pct of families by wealth held 54 percent of the value of corporate stocks and mutual funds, compared to 11 percent for 50thursday–90th percentiles, and less than i percentage for the lesser 50 percentage.

[5] For example, the Joint Committee on Tax (2012) states, "Economists mostly agree that, in theory, a Haig-Simons measure of income is the best measure of economic well-being."

[6] This approach would be less informative for middle-class families because they swallow a much larger share of their income.

[7] Nosotros lack directly show on the average tax rate paid by the highest-wealth families. In principle, the boilerplate tax charge per unit could differ in either direction. The highest-income families could pay a lower average tax rate because they are loftier-income due to big unmarried-year capital gains realizations that are taxed at low rates. Alternatively, the highest-wealth families could pay a lower share of their revenue enhancement-return income in taxes due to large charitable deductions.

[8] The Survey of Consumer Finances intentionally excludes from its sample anybody included in the Forbes 400 due to privacy concerns. However, some Forbes 400 wealth may be represented by families included in the Survey of Consumer Finances sample, and some additional observations are also excluded from the SCF sample. Bricker, Hansen, and Volz (2019) suggest a method for augmenting the SCF with the Forbes 400 data without double counting. We simplify past assuming that there is a abrupt cutoff between the two and do not rely on the Survey of Consumer Finances to compute any aggregates.

[9] Notation, all the same, that the assumption of full overlap would imply that the desired ratio for the summit 400 would be i. In upshot, under this set of assumptions, the value for the next 1000 would be a poor guide to the value for the top 400. In implementing the procedures described in this section, we use the 2001-2019 SCFs and average the resulting annual aligning factors across years in club to increase our effective sample size.

[10] Technically, because the SCF is a survey with sample weights, we hateful the observations that, when weighted, stand for these ranks. We divide SCF observations that cross relevant rank boundaries, allocating a proportionate share of the observation'southward weight to each side of the boundary.

[11] The appointment for which the Forbes 400 estimates wealth has varied over fourth dimension. In 2020, Forbes used market prices near the finish of July. In 2019, Forbes used market prices in September. For simplicity, we care for the Forbes 400 equally cease-of-year wealth estimates. The Forbes list is a mix of person-level information and immediate-family data. Past treating it as family-level (more precisely, taxation-unit-level) information, our estimate of income could potentially be somewhat conservative, though we anticipate this effect is small.

[12] We impute the State and local tax deductions for the top 400 for the period 2015–2018 as the acme 400's share of the tiptop 0.001 pct's State and local tax deductions in 2014 multiplied past the full deductions of the pinnacle 0.001 pct for 2015–2018. The 2017 tax police force limited the Country and local tax deduction. For 2018 just, we impute total Land and local taxation deductions of the elevation 0.001% tax units by multiplying 2018 top 0.001% Federal taxes past the ratio of full 2014-2017 State and local revenue enhancement deductions to total 2014-2017 top 0.001% Federal taxes.

[13] A farther timing effect that could arise is if the wealthy systematically realize uppercase gains just when they are non in the tiptop 400 past wealth. In this case, the revenue enhancement rate of the meridian 400 by wealth in each year could understate a life-cycle estimate of the tax charge per unit of the extremely wealthy. All the same, information technology is not clear that—if this is a business organisation—our estimate of the tax rate of the extremely wealthy is afflicted by it. If it were the instance that the extremely wealthy systematically practice not realize their income when they are in the top 400 by wealth, our aligning cistron may be an overestimate of their taxable income.

[14] The Congressional Upkeep Role (2021) recently estimated that the boilerplate Federal individual income taxation charge per unit of the highest-income 1 percent of households was about 24 percent for the period 2014 through 2018. Other analysts focus primarily on frontwards-looking estimates. The Treasury Department (2020) estimated that the average Federal individual income tax charge per unit of the highest-income 0.i percent of families in 2021 would exist 23 percent, and the Revenue enhancement Policy Centre (2021) estimated that it would exist 25 percent. The Joint Committee on Taxation (2021) estimated that the tax rate for families with incomes of at least $1 million would exist 26 percent. The 2017 Revenue enhancement Act reduced individual income revenue enhancement rates in 2018. However, this upshot is small relative to the difference between the average Federal individual income tax rate on the wealthiest that we gauge and the estimates cited here.

morrisoncolmilluke.blogspot.com

Source: https://www.whitehouse.gov/cea/written-materials/2021/09/23/what-is-the-average-federal-individual-income-tax-rate-on-the-wealthiest-americans/

0 Response to "Total Amount Income Tax Collected From Family Offices by the Us Treasury"

Post a Comment